In the meantime, you can check your e-file status online with TurboTax. Typically it takes 21 days to receive your refund after the IRS accepts your return. Our representatives cannot provide your requested refund amount, even after verifying your identity. The status of a refund is available electronically. Once the IRS accepts your return, they still need to approve your refund before they send it to you. To resolve your issue, review the Social Security number and refund amount you entered to confirm they're correct. After four attempts, you won't be able to access your status for 24 hours. If you enter information that doesn't match our system, you'll receive an error message. You cannot use Check Your Refund Status to view the status of a payment. If the line on your return where you request a refund amount is blank or you entered zero, you have not requested a refund and cannot use our Check Your Refund Status tool.

If you don't have a copy of your return, see I don't have a copy of my tax return. Find your requested refund amount by form and tax year If you filed Locate the refund amount you requested on your tax return using the chart below. Sorry your browser does not support inline frames.When you use Check Your Refund Status, you'll enter information we use to verify your identity. Please allow additional time for processing and review of refunds. To mitigate the spread of COVID-19, staffing is extremely limited and may delay the timeframe to review refund requests.

#Tax return status manual#

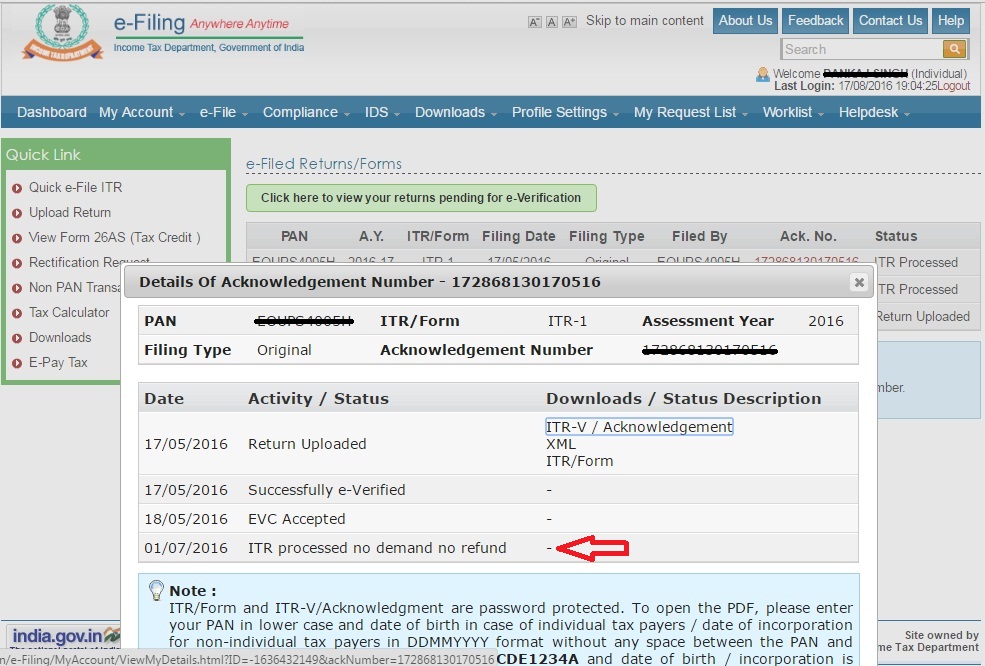

Returns that require manual processing may take longer regardless of whether the return was filed electronically or by paper. Other Refunds Status of paid refund, being paid other than through Refund Banker, can also be viewed at by entering the PAN and Assessment Year. In such cases, we cannot send a refund until the filer responds with the requested information. Taxpayers can view status of refund 10 days after their refund has been sent by the Assessing Officer to the Refund Banker. Beginning in January, we process Individual Income. How New Jersey Processes Income Tax Refunds. That may make taxpayers nervous about delays in 2022, but most Americans should get their refunds within 21 days of filing, according to the IRS. Please allow the appropriate time to pass before checking your refund status: E-filed Returns. In some cases, they will send a filer a letter asking for more information. Wait 12 weeks to check your refund if you filed a paper return. IRS is in crisis, Taxpayer Advocate warns. However, staff members do look at some returns manually to see whether the taxpayer filed income, deductions, and credits correctly. We have received your tax return and we’ve started processing it. We process most returns through our automated system. When you check the progress of your tax return using our online services, you might see one of these statuses (not all tax returns will display all of these): In progress Processing You may see this status at 2 stages of processing.

Go to My Account and click on 'Refund/Demand Status'. Processing of paper tax returns typically takes a minimum of 12 weeks. To view Refund/ Demand Status, please follow the below steps: Login to e-Filing website with User ID, Password, Date of Birth / Date of Incorporation and Captcha. Electronic returns typically take a minimum of 4 weeks to process.

#Tax return status software#

Generally, we process returns filed using computer software faster than returns filed by paper. Wisconsin DOR My Tax Account allows taxpayers to register tax accounts, file taxes. The department may use any other collection method allowed by law as needed to collect the tax liability. Transferring information from returns to New Jersey's automated processing system Ģ.Ğnsuring that we transferred the information correctly ģ.Ĝhecking for inconsistencies as well as math and other errors. Where’s my refund - Alabama Department of Revenue Homepage > Where’s my refund FAQ Categories Petition for Refund View All Petition for Refund FAQs Where’s my refund The department may seize a state tax refund to reduce a tax liability. How New Jersey Processes Income Tax Refundsīeginning in January, we process Individual Income Tax returns daily.

0 kommentar(er)

0 kommentar(er)